Lehman Brothers

Lehman Brothers, a former Fortune 500 global financial services firm, was founded in 1850 in Montgomery, Montgomery County, by German Jewish immigrants Henry, Emanuel, and Mayer Lehman. Starting out as a general dry goods store, the business evolved into a cotton brokerage firm and opened an office in New York in 1858. Its activities were interrupted by the Civil War but resumed when the Lehman brothers moved to New York, where they helped establish the Cotton Exchange. The business diversified and expanded under the leadership of members of the Lehman family until 1969. The firm was at the center of the 2007 mortgage and 2008 banking and financial crises and filed for bankruptcy in September 2008, one of the largest ever bankruptcies.

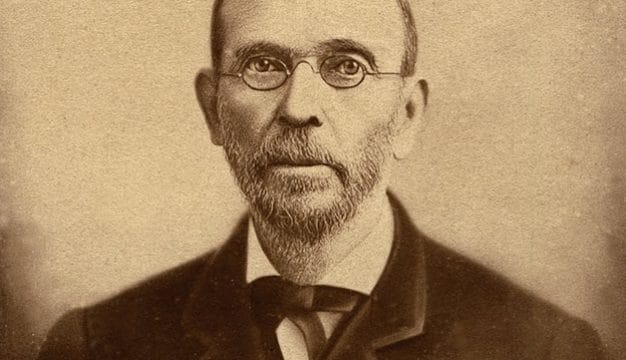

Emanuel Lehman

Henry Lehman, the first of the Lehman brothers to immigrate to the United States, arrived in Mobile in 1844 from Rimpar, Bavaria. Soon after his arrival, Henry loaded up a wagon with merchandise and spent the next year plying his goods along the Alabama River in exchange for cotton. Sometime in 1846 or 1847, he opened a dry goods store on Montgomery’s Commerce Street named “H. Lehman.” In 1847, his younger brother Emanuel joined him in Montgomery, and by the following year they were doing business as “H. Lehman and Brother” in a building on Court Square. When their younger brother Mayer arrived in 1850, they changed the name of the firm yet again to “Lehman Brothers.” The prosperous firm was able to stock a complete supply of dry goods owing to ready credit from fellow German Jewish suppliers in New Orleans.

Emanuel Lehman

Henry Lehman, the first of the Lehman brothers to immigrate to the United States, arrived in Mobile in 1844 from Rimpar, Bavaria. Soon after his arrival, Henry loaded up a wagon with merchandise and spent the next year plying his goods along the Alabama River in exchange for cotton. Sometime in 1846 or 1847, he opened a dry goods store on Montgomery’s Commerce Street named “H. Lehman.” In 1847, his younger brother Emanuel joined him in Montgomery, and by the following year they were doing business as “H. Lehman and Brother” in a building on Court Square. When their younger brother Mayer arrived in 1850, they changed the name of the firm yet again to “Lehman Brothers.” The prosperous firm was able to stock a complete supply of dry goods owing to ready credit from fellow German Jewish suppliers in New Orleans.

Cotton was Alabama’s main export crop in the 1850s, and the Lehmans agreed to accept the commodity from local planters in exchange for merchandise. This practice led the Lehmans to launch a separate business trading in cotton. Over the next several years, their cotton trading and brokerage business grew so much that in 1858 Emanuel Lehman opened an office in New York, which had become the nation’s commodity trading center. Henry Lehman had died from yellow fever in 1855, leaving Mayer Lehman to run the Montgomery businesses.

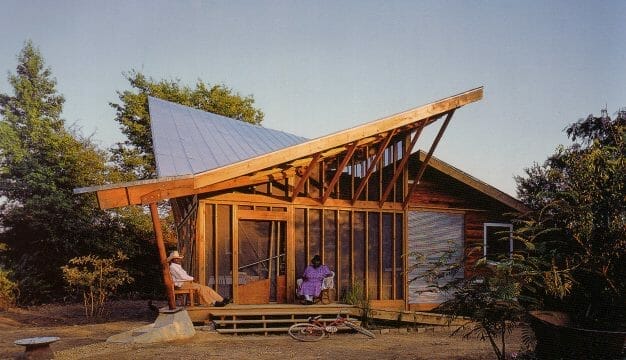

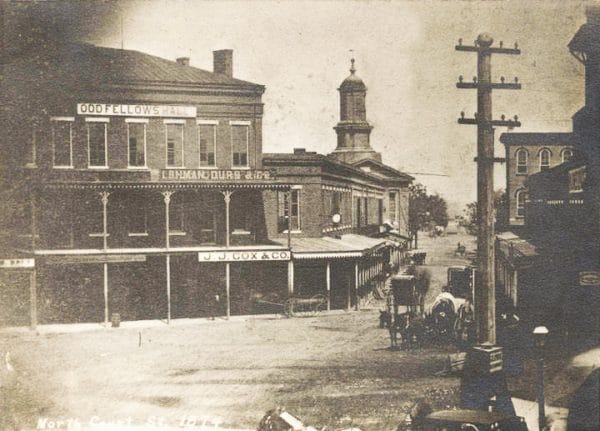

Lehman, Durr & Co., ca. 1874

Shortly after the onset of the Civil War, Mayer Lehman teamed up with Montgomery cotton merchant John Wesley Durr in 1862 to form Lehman, Durr and Company. (John Wesley Durr was civil rights activist Clifford Durr‘s grandfather.) But the continuation of the war interrupted the businesses in both Montgomery and New York. Mayer Lehman supported the Confederacy during the war by raising money for the relief of Alabama prisoners of war. In 1864, Mayer was appointed by Gov. Thomas H. Watts as a commissioner to visit Confederate soldiers confined in federal prisons. After the war, the Lehmans moved their headquarters from Montgomery to New York. Although the firm had left Alabama, it nevertheless continued to support the state during Reconstruction; Lehman Brothers was designated to be the state’s fiscal agent to help sell state bonds in 1867. The firm was also assigned to service the state’s debts, interest payments, and other obligations.

Lehman, Durr & Co., ca. 1874

Shortly after the onset of the Civil War, Mayer Lehman teamed up with Montgomery cotton merchant John Wesley Durr in 1862 to form Lehman, Durr and Company. (John Wesley Durr was civil rights activist Clifford Durr‘s grandfather.) But the continuation of the war interrupted the businesses in both Montgomery and New York. Mayer Lehman supported the Confederacy during the war by raising money for the relief of Alabama prisoners of war. In 1864, Mayer was appointed by Gov. Thomas H. Watts as a commissioner to visit Confederate soldiers confined in federal prisons. After the war, the Lehmans moved their headquarters from Montgomery to New York. Although the firm had left Alabama, it nevertheless continued to support the state during Reconstruction; Lehman Brothers was designated to be the state’s fiscal agent to help sell state bonds in 1867. The firm was also assigned to service the state’s debts, interest payments, and other obligations.

In 1870, the Lehmans took the lead in establishing the New York Cotton Exchange, the first commodities futures trading venture. Emanuel Lehman was appointed to the first board of directors and served until 1884. In the post-war period, as the country was transforming from an agrarian to an industrial economy, the firm began to deal in the expanding market for railroad bonds and also moved into the financial advisory business, which would lead to the development of an expertise in underwriting. Lehman Brothers’ entry into the securities trading business led it to become a member of the New York Stock Exchange in 1887.

In 1906, Lehman Brothers joined forces with the firm of Goldman Sachs and moved from cotton into the investment banking business. For the next 20 years, Emanuel’s son, Philip Lehman, and Henry Goldman, the dominant partner in Goldman Sachs, formed an alliance to underwrite securities for some of the most famous names in the emerging retailing industry, including Sears, Roebuck & Co.; F. W. Woolworth Co.; May Department Stores; Gimble Brothers, Inc.; and R.H. Macy & Co. During the 1920s, the firm took advantage of the rapidly developing economy, focusing on such industries as air travel, communications, and even entertainment, helping finance RKO, Paramount, and 20th Century Fox.

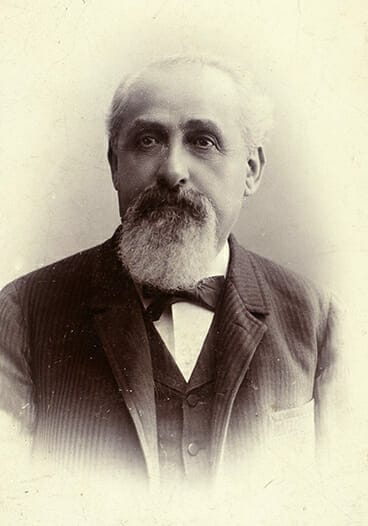

Mayer Lehman

Whereas other firms suffered heavily from the stock market crash of 1929 and the ensuing Great Depression, Lehman Brothers survived by focusing on venture capital. The firm then continued its tradition of identifying emerging industries and supporting their expansion and growth. In the 1930s, Lehman Brothers focused on radio and television; in the 1940s, on home appliance and automobile manufacturing; in the 1950s on electronics, the first computers, and the travel industry; in the 1960s and 1970s, on globalization and continued advances in electronics and information technology.

Mayer Lehman

Whereas other firms suffered heavily from the stock market crash of 1929 and the ensuing Great Depression, Lehman Brothers survived by focusing on venture capital. The firm then continued its tradition of identifying emerging industries and supporting their expansion and growth. In the 1930s, Lehman Brothers focused on radio and television; in the 1940s, on home appliance and automobile manufacturing; in the 1950s on electronics, the first computers, and the travel industry; in the 1960s and 1970s, on globalization and continued advances in electronics and information technology.

In 1984, Lehman Brothers was acquired by American Express and merged with its retail brokerage Shearson to form Shearson Lehman Brothers. American Express began to divest its financial services business lines in 1992 and eventually, in 1993, the firm was spun off and once again became known solely as Lehman Brothers. In 2000, Lehman celebrated its 150th anniversary. The company’s World Trade Center offices, located in One World Trade Center (the North Tower) were destroyed by the September 11, 2001, terrorist attacks, although only one employee was killed. Its global offices in Three World Financial Center were damaged beyond repair by debris from the towers. The company moved into its new global headquarters in midtown Manhattan in 2002. The following year, Lehman Brothers entered into a settlement with the U.S. Securities and Exchange Commission (SEC) and other securities regulators, paying $80 million in financial penalties for charges regarding undue influence over the firm’s research analysts by their investment banking division.

The firm regained its footing but was then caught up in the 2007 mortgage crisis. The value of its stock fell, and as losses of nearly $4 billion became public the following summer, the firm scrambled to raise capital. It failed to do so and was not included in the U.S. government’s bailout of other troubled financial institutions, the Emergency Economic Stabilization Act of 2008, which provided $700 billion to restore the banking industry. Lehman executives filed for bankruptcy on September 15, 2008, and the firm’s remaining subsidiaries, holdings, and real estate were sold to other investors. According to some analysts, the firm’s collapse was a key catalyst for the banking crisis that necessitated the government bailout. In related matters, chief executive officer Richard Fuld Jr. appeared before Congress that October to explain the firm’s sudden demise and the large amounts of money he earned despite Lehman’s troubled status. According to one government expert, Fuld’s compensation in the last five years of Lehman Brothers’ existence was nearly $270 million, whereas another expert noted that Lehman’s board was overloaded with individuals having little experience in modern banking practices.

Additional Resources

Libo, Kenneth. “The Moses and the Lehmans: From Montgomery to New York.” Alabama Heritage 36 (Spring 1995): 24-26.

Libo, Kenneth, William L. Bernhard, John Langeloth Loeb, and June Bingham. Lots of Lehmans: The Family of Mayer Lehman of Lehman Brothers, Remembered By His Descendants. Syracuse, N.Y.: Syracuse University Press. 2007.