Banking Industry in Alabama

Currently, there are 107 banks chartered in Alabama, with more than 1,400 offices located throughout the state, which includes branches of more than 30 banks chartered in other states. All banks are privately owned, and the most prominent banking area in the state is Birmingham. Banks play an essential role in the economic development of states by taking deposits through checking accounts and savings accounts and then lending the funds to consumers to purchase goods such as homes and automobiles and to small businesses to help fund their operations.

First National Bank of Huntsville

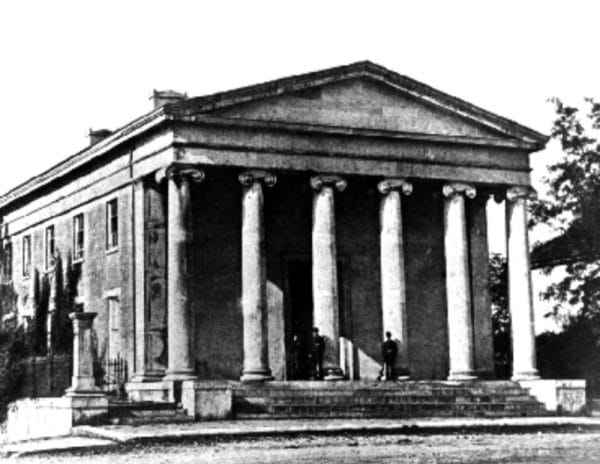

Available data indicate that only 31 banks were operating in Alabama in 1875, but that number grew to 107 by 1900. In that year, the total assets of the banks were $41 million, with about half that amount in state-chartered banks and the other half in federally chartered banks. The existence of both types of bank charters is referred to as “dual banking,” and this practice continues to the present. The state-chartered banks are regulated primarily by individual state banking departments, and the federally chartered banks are regulated primarily by the U.S. Office of the Comptroller of the Currency (OCC). The OCC was established in 1863, and the Alabama State Banking Department was established more than a half century later in 1911.

First National Bank of Huntsville

Available data indicate that only 31 banks were operating in Alabama in 1875, but that number grew to 107 by 1900. In that year, the total assets of the banks were $41 million, with about half that amount in state-chartered banks and the other half in federally chartered banks. The existence of both types of bank charters is referred to as “dual banking,” and this practice continues to the present. The state-chartered banks are regulated primarily by individual state banking departments, and the federally chartered banks are regulated primarily by the U.S. Office of the Comptroller of the Currency (OCC). The OCC was established in 1863, and the Alabama State Banking Department was established more than a half century later in 1911.

Penny Savings Bank

The operations of both types of banks and the ways in which they are regulated and supervised are quite similar today. Both types, moreover, offer deposits that are insured up to $250,000 per account by the Federal Deposit Insurance Corporation (FDIC), created by legislation cosponsored by Alabama congressman Henry B. Steagall. This federal government agency was established during the Great Depression to protect depositors from losses in the event of a bank failure. But the primary purpose of deposit insurance is to prevent depositors from “running” on banks. When depositors become concerned about the safety of their deposits, they might run to banks to withdraw their funds, which could send otherwise financially healthy banks into insolvency by forcing them to sell assets at depressed prices to meet deposit withdrawals. The reason for selling assets is that banks do not actually keep enough cash on hand to allow all depositors to withdraw their funds at once. Instead, they try to earn profits by using the majority of deposits to make loans to other individuals and businesses.

Penny Savings Bank

The operations of both types of banks and the ways in which they are regulated and supervised are quite similar today. Both types, moreover, offer deposits that are insured up to $250,000 per account by the Federal Deposit Insurance Corporation (FDIC), created by legislation cosponsored by Alabama congressman Henry B. Steagall. This federal government agency was established during the Great Depression to protect depositors from losses in the event of a bank failure. But the primary purpose of deposit insurance is to prevent depositors from “running” on banks. When depositors become concerned about the safety of their deposits, they might run to banks to withdraw their funds, which could send otherwise financially healthy banks into insolvency by forcing them to sell assets at depressed prices to meet deposit withdrawals. The reason for selling assets is that banks do not actually keep enough cash on hand to allow all depositors to withdraw their funds at once. Instead, they try to earn profits by using the majority of deposits to make loans to other individuals and businesses.

As a result of the Great Depression and more recent financial crises, it is widely acknowledged that well-functioning banking systems are vital for financial stability and economic development. Conversely, when banking systems function poorly, credit is either not adequately available or is misdirected to less productive uses. In such situations, the result is not only an increase in the likelihood of a banking crisis but also slower economic growth than would otherwise occur. More generally, banking systems that perform well contribute in important ways to economic development, reducing income inequality, alleviating poverty, and promoting financial stability. This is the case for the banking sector in Alabama as well as the banking sectors in the other states and other parts of the world.

Alabama was not immune to the effects of the U.S. financial crisis during the period 2007 to 2009. Some banks in the state failed as the crisis led to a collapse in real estate values, record home foreclosures, and depressed economic activity. Most notable of the bank failures in the state was that of Colonial BancGroup that failed in August 2009. The failure of this institution was the sixth-largest bank failure in the United States at the time. Colonial had grown rapidly with operations not only in Alabama but in Florida, Georgia, Texas, and Nevada. The branches and deposits of Colonial were sold to BB&T Corporation—a large banking organization headquartered in North Carolina.

Fortunately for people living in Alabama, the banking industry has performed relatively well throughout its existence compared with the entire U.S. banking industry. According to the FDIC, as of March 2021, 103 commercial banks were headquartered in Alabama with total assets of $309 billion and more than 36,000 employees. Also, Alabama had four savings institutions with $65 million in assets and 193 employees. Approximately 99.7 percent of the assets are in state-chartered banks, with the primary regulator being the Alabama State Banking Department. Nationwide, Alabama ranks 12th in terms of total assets, higher than all southeastern states except North Carolina, which ranks third with $2.9 trillion in total assets. Alabama’s relatively high-ranking results from the strategy of many Alabama banks to expand into other states through mergers and acquisitions as well as branches, allowing them to service more customers and thereby increase their total assets.

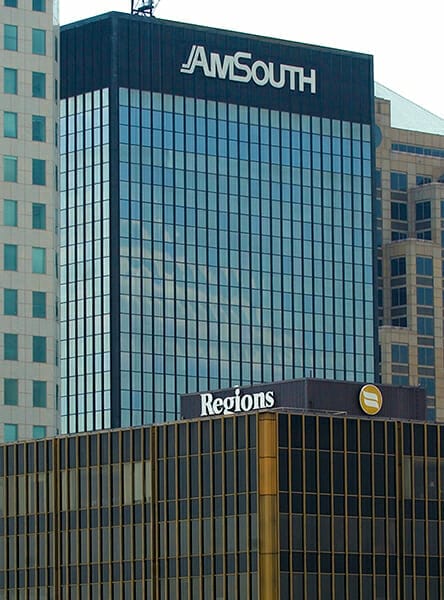

Regions-AmSouth Merger

The biggest bank in Alabama as of March 2021 was Regions Bank, which was established in 1871 and accounts for roughly 50 percent of total banking assets in the state. AmSouth Bank merged with Regions Bank in 2006, following the 2004 acquisition of SouthTrust Bank by Wachovia, a North Carolina banking organization. Because of such consolidation, relatively few banks account for the majority of the assets in Alabama’s banking industry. But this trend is not unique to the state, as consolidation has been happening throughout the United States in recent years as banks merge with and acquire other banks. More importantly, recent research finds that increased consolidation does not necessarily imply less competition in banking and therefore is unlikely to result in higher prices for services, especially as a result of the widespread online banking that enables customers to shop for banking services nationwide.

Regions-AmSouth Merger

The biggest bank in Alabama as of March 2021 was Regions Bank, which was established in 1871 and accounts for roughly 50 percent of total banking assets in the state. AmSouth Bank merged with Regions Bank in 2006, following the 2004 acquisition of SouthTrust Bank by Wachovia, a North Carolina banking organization. Because of such consolidation, relatively few banks account for the majority of the assets in Alabama’s banking industry. But this trend is not unique to the state, as consolidation has been happening throughout the United States in recent years as banks merge with and acquire other banks. More importantly, recent research finds that increased consolidation does not necessarily imply less competition in banking and therefore is unlikely to result in higher prices for services, especially as a result of the widespread online banking that enables customers to shop for banking services nationwide.

The most recent data indicate that in March 2021, the FDIC-insured banks in Alabama had a return on assets (ROA) of 1.01 percent and a return on equity (ROE) of 9.11 percent. These figures compare to a ROA of 1.34 percent and an ROE of 11.44 percent, respectively, for all FDIC-insured institutions. ROA is considered a measure of the overall profit a bank is earning on its assets. Those assets include all types of loans and investments in securities (stocks and bonds). ROE is a measure of the rate of return to stockholders. Although both ROA and ROE for Alabama’s banks were slightly lower than for all banks in the United States, they are still respectable.

Alabama banks generally have been viewed as conservative lenders, making loans mainly to customers who are better able to repay. Over time, this conservative lending strategy has helped protect many Alabama banks from major losses during periods when the economy has been in a slump. Of course, economic activity always has up and down periods, referred to as business cycles, that lower the profitability of all banks during the downturns, including banks in Alabama. When severe enough, the down cycle can cause some banks to fail.

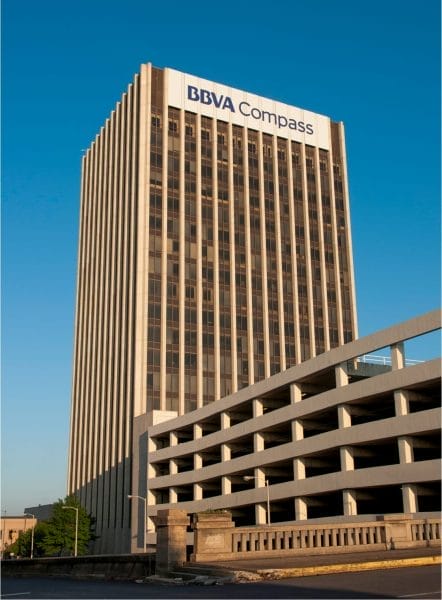

BBVA Compass Bank

Over time, especially in recent years, some Alabama banks have expanded beyond their borders, and outside banks have entered Alabama. As a result of these developments, Regions Bank (accounting for 23 percent of total deposits in the state as of June 2020), has more deposits outside the state than within the state. BBVA USA, which PNC Financial Services Group received regulatory approval to acquire in May 2021, is the bank with the second largest market share at 16 percent. It, like Regions Bank, has more deposits outside the state of Alabama. Wells Fargo Bank, although not chartered in Alabama, is the bank with the third-largest share, at nearly 8 percent. These developments reflect the fact that legislative changes have allowed banks chartered in different states to expand to a greater extent nationwide in recent years.

BBVA Compass Bank

Over time, especially in recent years, some Alabama banks have expanded beyond their borders, and outside banks have entered Alabama. As a result of these developments, Regions Bank (accounting for 23 percent of total deposits in the state as of June 2020), has more deposits outside the state than within the state. BBVA USA, which PNC Financial Services Group received regulatory approval to acquire in May 2021, is the bank with the second largest market share at 16 percent. It, like Regions Bank, has more deposits outside the state of Alabama. Wells Fargo Bank, although not chartered in Alabama, is the bank with the third-largest share, at nearly 8 percent. These developments reflect the fact that legislative changes have allowed banks chartered in different states to expand to a greater extent nationwide in recent years.

The growing consolidation within the banking industry has been facilitated by the Riegle-Neil Interstate Banking and Branching Efficiency Act of 1994 and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The earlier act overrode state law by allowing banks outside individual states to purchase existing banks in other states. Still, it did not allow banks in individual states to open branches in other states without purchasing an in-state bank. The later act overrode state law by allowing for nationwide branching. As a result of these two acts, there has been a greater consolidation within banking throughout the United States, including Alabama. Banks welcome the ability to achieve more significant consolidation through geographical expansion because they now compete with one another and with nonbank financial institutions such as securities firms, insurance companies, hedge funds, and capital markets more generally. Through consolidation, banks become larger and able to offer a broader range of services over greater geographical distances at better prices to consumers. Given these developments, Alabama banks like all banks continue to be an important factor in contributing to economic growth and development in the state and throughout the country.

Two major organizations represent the banking sector in Alabama. The Alabama Bankers Association was organized in 1890 to represent the interest of banks in Alabama. The association provides assistance to banks through educational programs and information. The Community Bankers Association of Alabama also promotes sound banking practices through education and other services to their member banks, which are typically smaller banks. Both organizations are very active in the state of Alabama in terms of promoting safe and sound banking practices.

Additional Resources

Curtis, Wayne C. Establishing and Preserving Confidence: The Role of Banking in Alabama, 1816-1994. Montgomery: Alabama Bankers Association, 1994.